2 min read

An Unreliable Grid Leads to Expensive Power Outages

The North American Electric Reliability Corporation (NERC) released its 2022 Summer Reliability Assessment this month. The assessment identifies,...

American Clean Power released their Q2 market report for 2022 at the end of July.

Key takeaways from the ACP market report include:

Many drops in project installations in Q2 are due to policy and supply chain challenges. According to ACP, more than 8 GW of clean energy capacity that was expected to come online this quarter has been delayed through 2026. Since the end of 2021, more than 32 GW of capacity has been delayed and has not yet achieved commercial operation.

Meeting North American clean energy goals does not have to rely entirely on installing new projects. Though it does sound like the most obvious way to bring us to 70-80% energy produced by clean sourced by 2050. In the meantime, while policy and supply chain challenges continue to be an issue, owners, operators, asset managers and other clean power stakeholders will need to consider getting the most energy potential out of their existing assets.

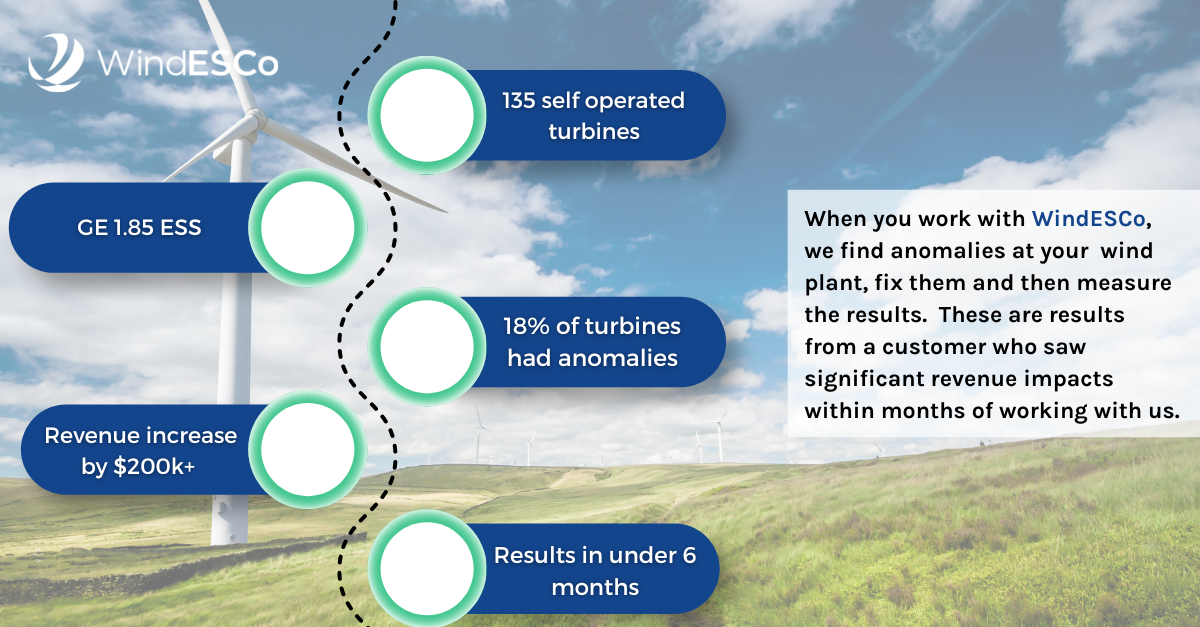

At a US wind farm, we found 18% of the wind turbines examined per site exhibiting fixable issues. This negatively impacted the wind site performance. After fixing these underperformance issues at the wind farm, the plant was able to gain over $200,000 back in lost revenue in less than 6 months.

To combat static yaw misalignment and other sources of wind turbine underperformance, WindESCo offers Find, Fix, Measure to find these fixable issues while leveraging extensive subject-matter expertise to provide actionable recommendations to correct anomalies.

To date, WindESCo has provided recommendations to correct static yaw misalignment and other issues on several GWs of wind capacity, allowing wind energy stakeholders to recover what would otherwise be lost annual energy production and revenue.

Interested in increasing the wind energy production for your existing wind site? Contact us to recover your losses.

2 min read

The North American Electric Reliability Corporation (NERC) released its 2022 Summer Reliability Assessment this month. The assessment identifies,...

WindESCo is attending Wind Asset Management Europe next week (July 6-7) in Madrid. WAME is uniting the European wind value chain to optimize wind...

The wind industry is experiencing challenges and uncertainty once again this year. Between policy changes, supply chain cost increases & delays, and...